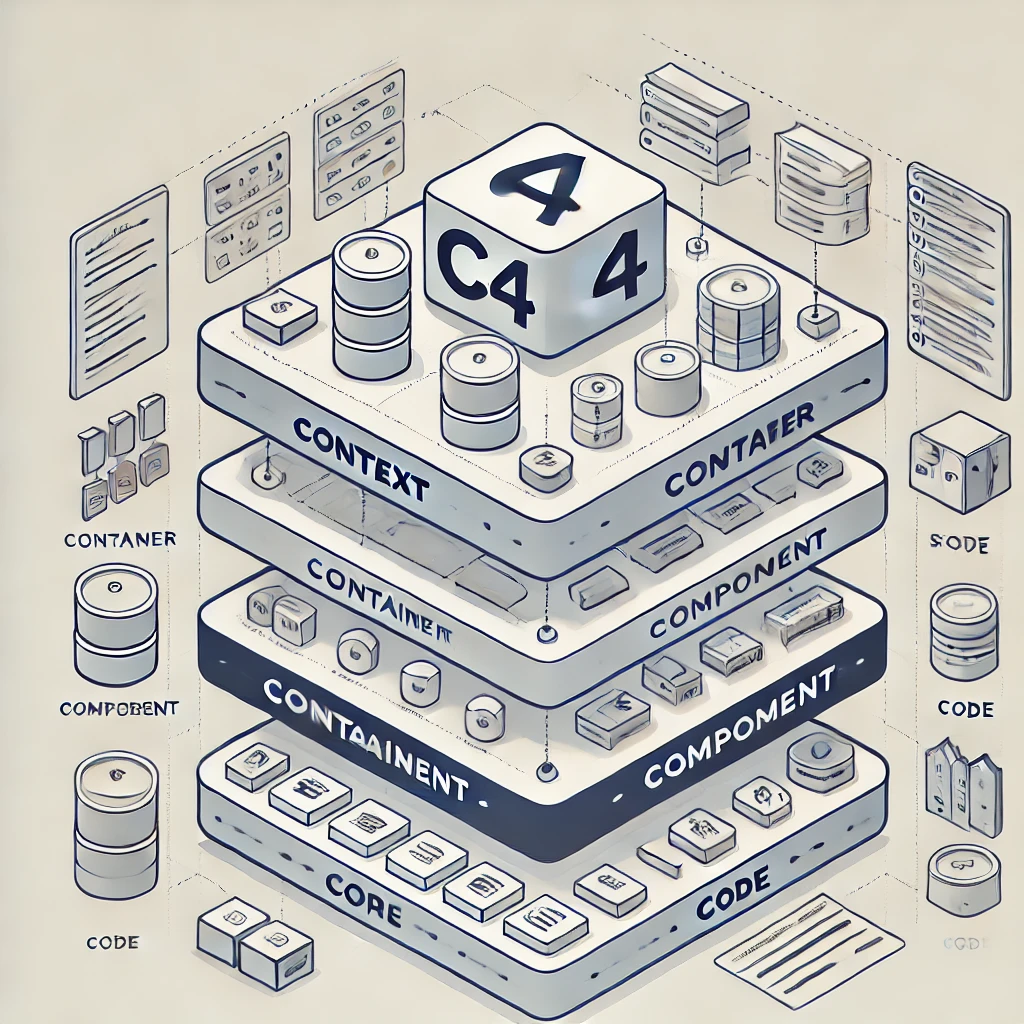

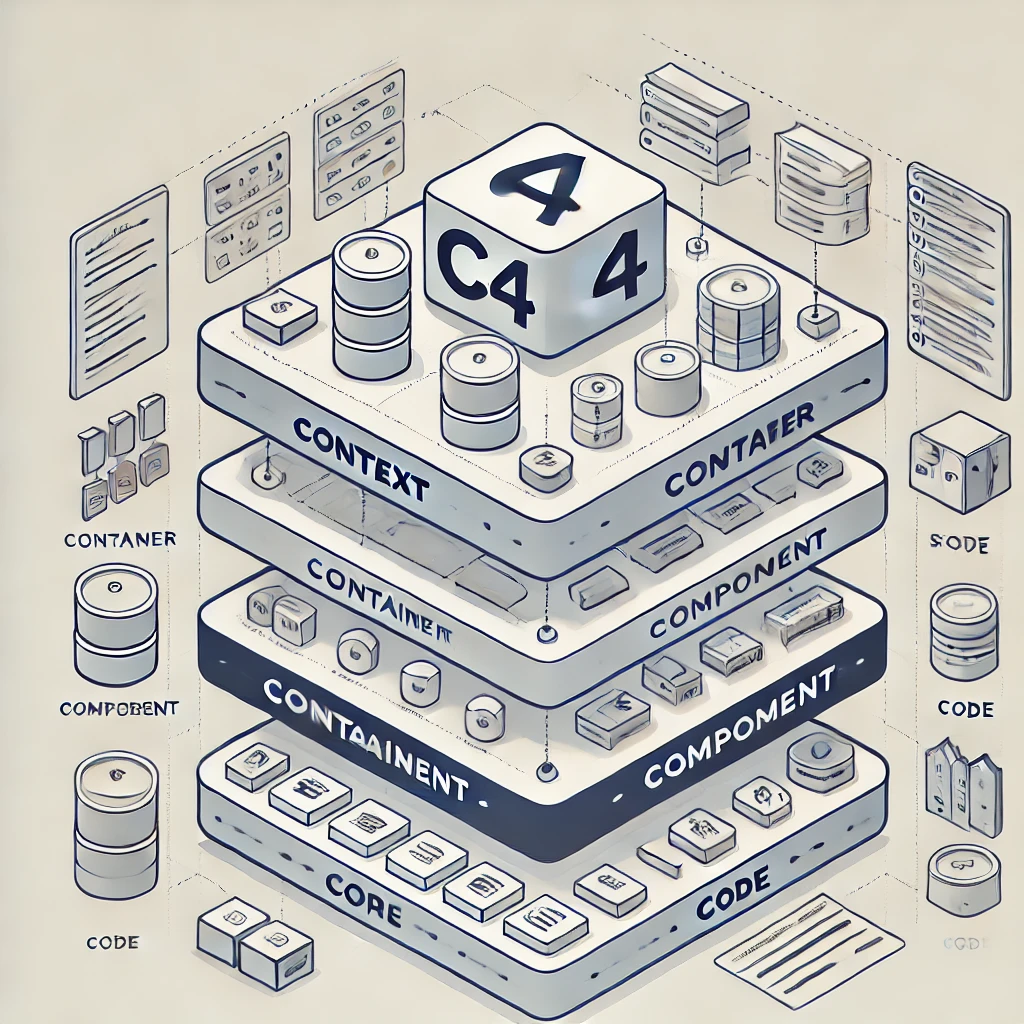

Software architecture forms the backbone of any successful system, defining the structure and interactions among its components. However, effectively communicating architecture to various stakeholders—developers, business analysts, or executives—can often be challenging. The C4 Model, created by Simon Brown, provides a lightweight yet powerful framework for visualising software architecture in a structured and scalable way. This model offers a systematic approach across four levels of abstraction: Context, Container, Component, and Code.

The Context level captures the big picture, answering what the system does, its purpose, and how it interacts with external entities. This high-level overview is perfect for executives or non-technical stakeholders to understand the system’s scope and key interactions. For example, an e-commerce platform’s Context diagram might highlight interactions with customers, payment gateways, and shipping providers, offering a clear, broad understanding of the system's environment.

The Container level dives into the system’s building blocks, such as applications, services, and databases, and focuses on their communication mechanisms. This level is aimed at technical stakeholders who need to understand how the system is structured and how its components interact. Using the same e-commerce example, the Container diagram might showcase a web application, an order management backend service, and a database, along with their communication protocols.

At the Component level, the focus shifts to the internal workings of individual containers. This deeper level of abstraction highlights the key components, their responsibilities, and their interactions within a container. For instance, the order management service might have components like an Order Processor, Payment Integration Module, and Notification Service, detailing how they work together to process orders and notify customers.

The Code level offers the most granular view, delving into implementation details. While optional, this level can be useful for development teams requiring detailed insights into the source code structure, such as class diagrams or methods used within a specific module. Using UML or similar tools, this level can visualize the finer details, such as how an Order Processor class interacts with a database repository.

The C4 Model stands out because it provides clarity across stakeholders, ensuring that everyone, from executives to developers, can understand the architecture at the appropriate level of detail. It scales well for projects of varying sizes, maintains consistent communication through structured diagrams, and emphasizes abstractions that evolve logically from high-level context to low-level details. These characteristics make it an invaluable tool for teams aiming to align on architectural decisions.

Creating C4 diagrams can be facilitated by tools like Structurizr, PlantUML, or general diagramming platforms such as Lucidchart or Draw.io. Best practices for adopting the C4 Model include starting at the Context level before moving to deeper levels, keeping diagrams simple, using consistent notation, iterating with feedback, and documenting assumptions alongside the diagrams.

The C4 Model is a practical and effective way to communicate software architecture, ensuring alignment across technical and non-technical stakeholders. By layering abstraction and focusing on the essentials, it bridges the gap between complexity and clarity. Whether you’re a developer, architect, or technical leader, adopting the C4 Model can significantly improve how software systems are visualized and understood. Start using it in your projects to experience its benefits firsthand.