I was often told by my teachers that Hong Kong is an international financial center. Indeed, in our highly competitive corporate environment, we enjoy economic success daily. However, Hong Kong currently lags in the FinTech revolution. Singapore has seized this opportunity and has aggressively moved ahead. The Singaporean government has played a crucial role in attracting FinTech companies by providing incentives and clear regulations. Moreover, the extensive client base available to mainland China's FinTech firms has enabled them to thrive in ways that Hong Kong companies haven't.

The challenge is clear: Hong Kong's risk-averse mentality is slowing the progress of the FinTech industry. As an IT consultant, I've heard numerous individuals in the banking sector express concerns about innovations like blockchain, Bitcoin, and mobile payments. They fear these technologies could disrupt their businesses, jeopardize jobs, and result in big companies failing to adapt.

However, there's a silver lining: Hong Kong is home to a large number of innovative and creative individuals. Our community boasts a diverse group of thinkers, builders, and leaders. We have the potential to assemble outstanding teams that can inspire and contribute to the creation of the world's best FinTech ecosystem. Now is the time to elevate our awareness and reimagine what is possible when financial technology serves as a catalyst for positive industry transformation.

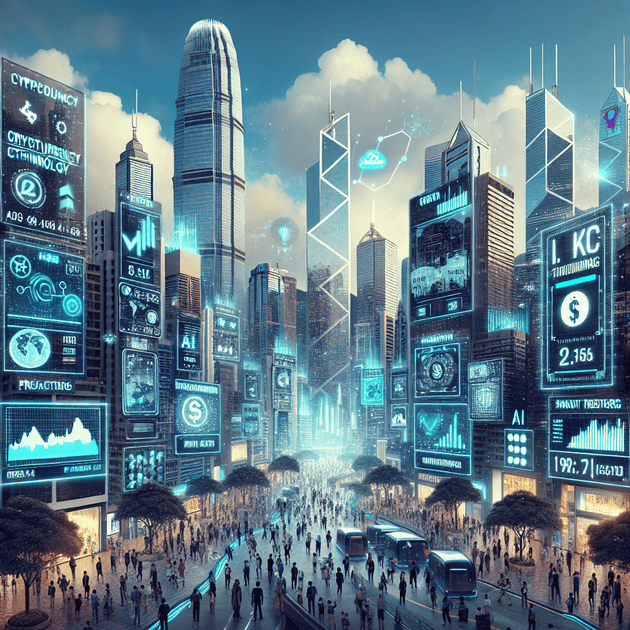

In my opinion, this is the desired outcome: we are guiding global financial technology to become more human-centered. Our current legal sandbox policy allows companies to test their innovative ideas in the marketplace. These financial technologies have the potential to positively impact people's lives around the globe. Together, let's utilize the language and tools of FinTech to reestablish Hong Kong as the regional hub for FinTech commerce.